3 Critical US Tax Tips for Investing in Costa Rica

Planning to invest in Costa Rica? Don’t let US tax compliance catch you off guard. These three critical tax tips will help you avoid penalties, preserve tax benefits, and potentially save thousands in taxes when investing in Costa Rican real estate.

Costa Rica offers attractive features for real estate investment, including beautiful coastlines and favorable tax policies. But - As international tax specialists working with investors in Costa Rica, we frequently see preventable tax issues arise from seemingly simple real estate investments. Whether you’re considering purchasing a vacation home, rental property, or commercial real estate in Costa Rica, understanding these three critical US tax considerations can save you significant money and headaches.

As international tax specialists working with investors in Costa Rica, we frequently see preventable tax issues arise from seemingly simple real estate investments. Whether you're considering purchasing a vacation home, rental property, or commercial real estate in Costa Rica, understanding these three critical US tax considerations can save you significant money and headaches.

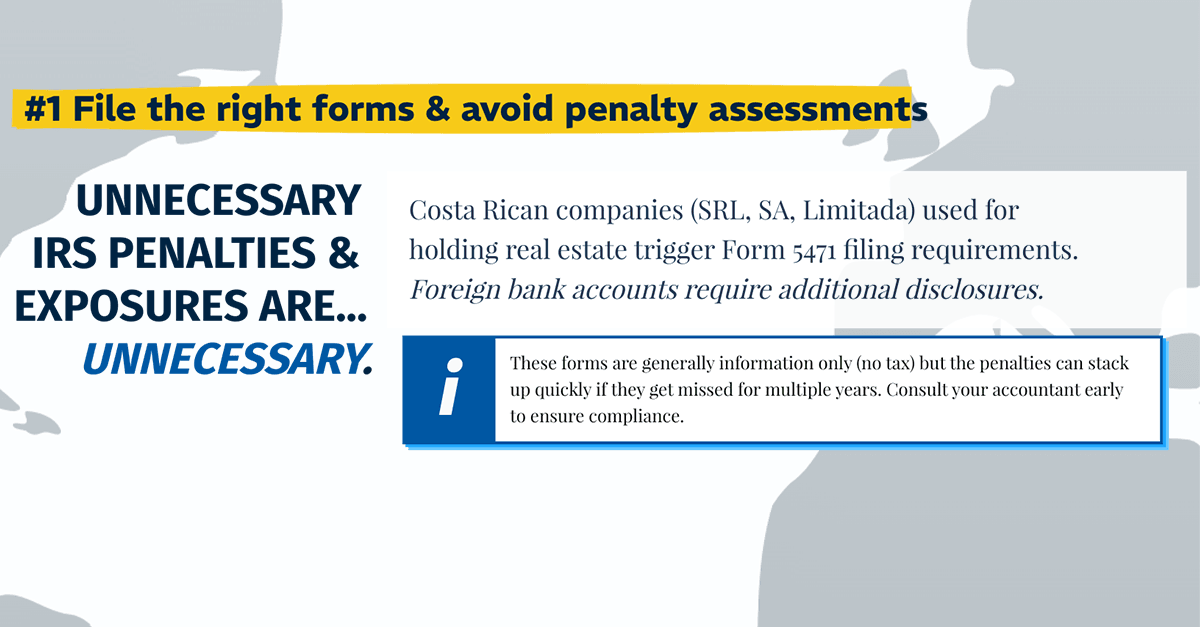

#1 Essential Form Filing: Avoiding Costly IRS Penalties

Remember: Unnecessary IRS penalties are just that: UNNECESSARY!

Let's start with a simple truth: unnecessary IRS penalties and exposures are, well, unnecessary. The IRS is particularly harsh when it comes to penalties for international reporting forms, and these can catch even experienced investors off guard.

From a commercial perspective, Costa Rican business entities (SRLs, SAs, and Limitadas) often make perfect sense for holding real estate. However, US citizens need to understand that these structures trigger specific US tax reporting requirements by default. Most notably, ownership in these entities typically requires filing Form 5471 with your US tax return.

Something foreign buys are often surprised by is that if you open Costa Rican bank accounts for your investment, you'll likely need to file Foreign Bank Account Reports (FBARs) and possibly Form 8938 (Statement of Specified Foreign Financial Assets). Understanding these filing requirements is critical to avoid expensive surprises years down the road.

Here's the critical point: while these forms are generally informational in nature (meaning they don't typically result in additional tax), the penalties can stack up quickly if they get missed for multiple years - often $10,000 or more per form per year. The IRS shows little leniency for missed international filings, even when there's no tax due.

The solution is straightforward: discuss these requirements with your accountant early in the investment process. Make sure you understand exactly which forms apply to your situation and have a system in place to meet these filing obligations consistently. As we often tell our clients, an ounce of prevention is worth a pound of cure when it comes to international tax compliance.

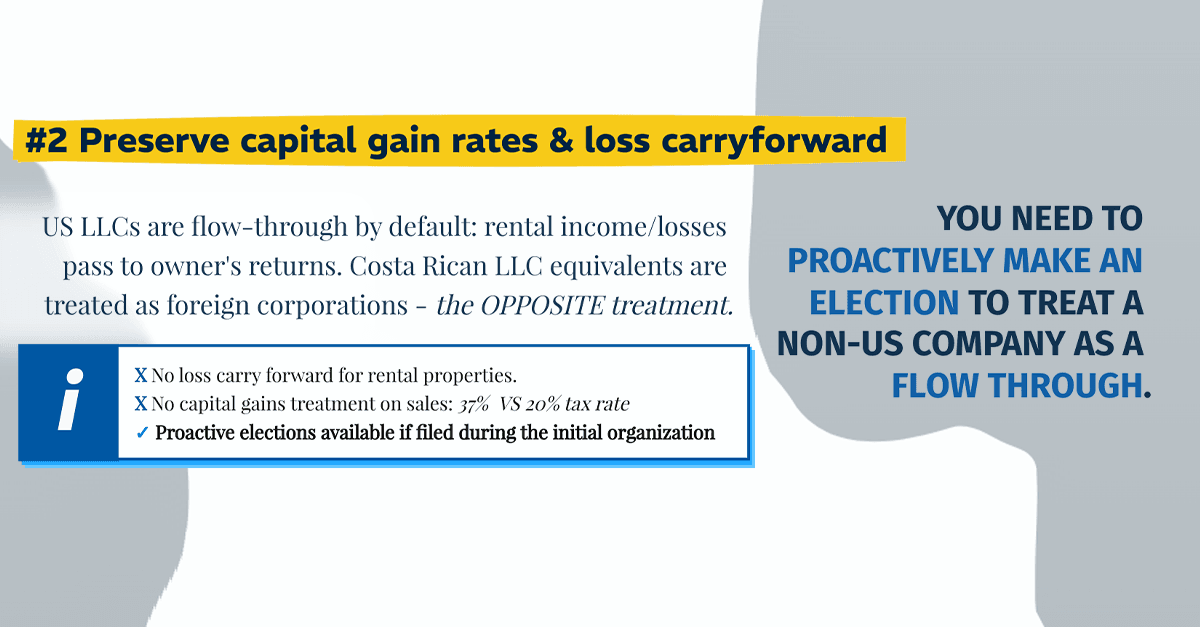

#2 Strategic Entity Selection: Preserving Tax Benefits

Foreign direct investment in Costa Rica is supported by favorable government policies, making it an attractive destination for international investors. But we need to tackle a critical misconception that can cost investors thousands in unnecessary taxes.

When you set up an LLC in the United States, the default treatment is that of a "flow-through" entity. This means that income or losses from your rental property flow directly through to your personal tax return. Plus, when you eventually sell the property, you generally benefit from preferential capital gains tax treatment (with the exception of depreciation recapture).

However, a non-US LLC has the OPPOSITE outcome.

If you set up the equivalent of an LLC in Costa Rica (like an SRL or SA), the IRS automatically treats it as a foreign corporation. This default classification triggers a myriad of complexities, but two major issues stand out:

- Loss Limitations: Rental property losses in a Costa Rican entity may not be deductible against your other US income

- Higher Tax Rates: Property sales could be taxed at ordinary income rates instead of preferential capital gains rates.

The tax impact can be substantial - we're talking about the difference between a 20% capital gains rate and a 37% ordinary income rate on your eventual sale!

Set up your Costa Rican company correctly from the start.

Here's the good news: you have options. In many cases, you can proactively elect to treat your Costa Rican company as a flow-through entity for US tax purposes, preserving both the loss carryforwards and capital gains treatment. However - and this is crucial - this election must be made when you first organize the company. It can be difficult or impossible to fix retroactively when you realize the tax implications years later.

#3 Maximizing Real Estate Professional Benefits

We all want passive income, right? Well - not when we're talking about taxes.

Multinational companies like Sony and Coca-Cola operate in Costa Rica, highlighting the country's welcoming stance towards foreign investors.

Let's discuss a powerful tax strategy that many Costa Rican property investors overlook. As a general rule, rental real estate activity is considered "passive" for US tax purposes. This classification has two significant drawbacks:

- Your rental income gets hit with an additional 3.8% net investment income tax

- Any net losses are essentially "locked away" until you either generate passive income to offset them or sell the property

However, qualifying as a "real estate professional" for US tax purposes can completely change this picture. Under these rules, you can convert your rental activity from "passive" to "active," opening up some valuable tax planning opportunities.

Here's what it takes to qualify:

- You must spend at least 750 hours per year materially participating in real estate businesses (like managing your rental properties)

- Real estate must be your primary business activity - meaning you spend more time on this than any other business venture

This is where retiring to Costa Rica or working remotely can actually work in your favor. Since you need to spend more time on real estate activities than any other business activity, qualifying can be challenging if you have a full-time job. However, if you're retired or not working in another capacity, managing your Costa Rican properties could be the perfect way to meet these requirements.

Qualifying as a "Real Estate Professional" while working another full time job.

Here's a pro tip that many investors miss: on a joint tax return, only one spouse needs to qualify as a real estate professional for the benefits to apply to both spouses. For example, if one spouse qualifies as a real estate professional, rental losses could potentially offset the other spouse's salary or business income.

The bottom line? For those able to meet the requirements, real estate professional status can be a game-changer for your US tax situation. It's not just about avoiding the 3.8% surtax - it's about unlocking the ability to use your rental property tax losses when they occur, rather than waiting years to realize their benefit.

The full picture: Tax Implications for US Investors in Costa Rica

Investing in Costa Rica can have significant tax implications for US investors. The Costa Rican government offers various incentives for foreign investors, including tax exemptions and deductions. However, US investors must also consider the tax implications in the United States.

The US and Costa Rica have a tax treaty that aims to avoid double taxation and fiscal evasion. This treaty facilitates the exchange of tax information between the two countries, helping to prevent tax evasion and ensuring compliance.

US investors in Costa Rica may be subject to taxation on their rental income, capital gains, and dividends. While the tax rates in Costa Rica are generally lower than in the US, investors may still be required to pay taxes in the US on their foreign-sourced income. This dual tax obligation can be complex, but there are strategies to minimize tax liabilities.

To optimize your tax situation, consider the following:

- Claim the Foreign Earned Income Exclusion (FEIE): This allows you to exclude a certain amount of foreign-sourced income from your US taxable income.

- Claim Foreign Tax Credits: You can offset US taxes with the taxes paid in Costa Rica, reducing your overall tax burden.

- Strategic Structuring: Properly structuring your investment can help minimize US tax liabilities.

- Consult a Tax Professional: Navigating the intricacies of US and Costa Rican tax laws requires expert advice to ensure compliance and optimize tax benefits.

By understanding these tax implications and planning accordingly, you can make the most of your investment in Costa Rica while staying compliant with US tax laws.

Planning for Success

Costa Rica continues to attract US investors with its beautiful landscapes, stable government, and attractive real estate opportunities. For deeper insights into the legal aspects of purchasing property in Costa Rica, check out our recent podcast episode with Rick Philps, an expert in Costa Rican real estate and immigration law: How to Legally Navigate Costa Rican Property Purchases.

However, success requires careful attention to US tax compliance and planning. At McGowin Tax, we specialize in helping investors navigate these complexities. Contact us for a consultation to ensure your Costa Rican investment is structured optimally from a US tax perspective.