Foreign Earned Income Exclusion for Partnerships: An Expat Tax Guide

Welcome to another installment of the Practical Expat Tax Adviser. This series is designed to identify a common crossborder tax question and then provide the practical US tax considerations for the given situation that the standard human can understand.

For those of us who have less of a life are more technically inclined, I end the article with a breakdown of the legal support and basis for the considerations provided.

THE QUESTION

“Ive been reading your newsletter and feel confident that I qualify for the foreign earned income exclusion. Ive been claiming it for years on my self-employment income from my LLC. However, this year I took on a partner in the US who is doing a lot of the work. Can I still get the foreign earned income exclusion on my share of the partnership income?”

- International Tax Payer

Today’s problem is looking at what partnership income we can and cannot apply to the foreign earned income exclusion. Also, what practical tips we can use to be as tax efficient as possible.

THE PRACTICAL

The foreign earned income exclusion (“FEIE”) allows you to exclude around $125k of your foreign earned income from US taxation (depending on the year). In this case, we will be looking to make sure the partner’s share of partnership income is both "foreign" and "earned".

Below are my two general suggestions for maximizing the FEIE in this case. Which route we go will depend on some of the more detailed facts with respect to the business. For example, how much of the business is derived from capital assets vs services. Also, getting an understanding of the services performed outside the US in relation to the business as a whole as well as the overall profitability of the business.

Option #1: Guaranteed Payments

Make guaranteed payments from the partnership.

This is the simplest option and is what I tend to recommend. A partner in a partnership cannot earn a salary (i.e., they cannot also be an employee) but they can get paid what's called a "guaranteed payment" which is essentially a payment for services irrespective of the company's profits.

The IRS has recognized this as "earned" income for purposes of the foreign earned income exclusion so this is a very clear cut solution. Note that the FEIE does not offset self-employment income, so that will likely still be applicable.

Option #2: Split the income at the border

Have the partnership agreement specify that all foreign source gross income is specifically allocated to the partner outside the US.

This is another, more complicated option if for some reason a guaranteed payment does not work from a practical perspective. We have to first ensure that the partnership has foreign source income and then specify that such income is specifically allocable to you. The 2nd part is relatively easy. It is the first part that can be tricky because we have to value what part of the revenue is attributable to services you're physically performing outside the US. Then we have to allocate and apportion expenses from the business to that income.

This valuation can get a little complicated depending on the specific facts but we can come up with a reasonable allocation.

It is important to talk through each option in more detail to apply them to your specific facts and see what makes the most sense. We always want to strike the right balance between tax savings and simplicity.

THE SCIENCE

Claiming the FEIE is certainly an option in this scenario but it is not as straightforward as you may think. Let's walk through how I get to these suggestions from a technical perspective.

I have written in other articles about the general FEIE qualification rules and what makes it "foreign" and "earned". Here we are going to drill down on partnership/business income.

Using the FEIE for self-employed business in general

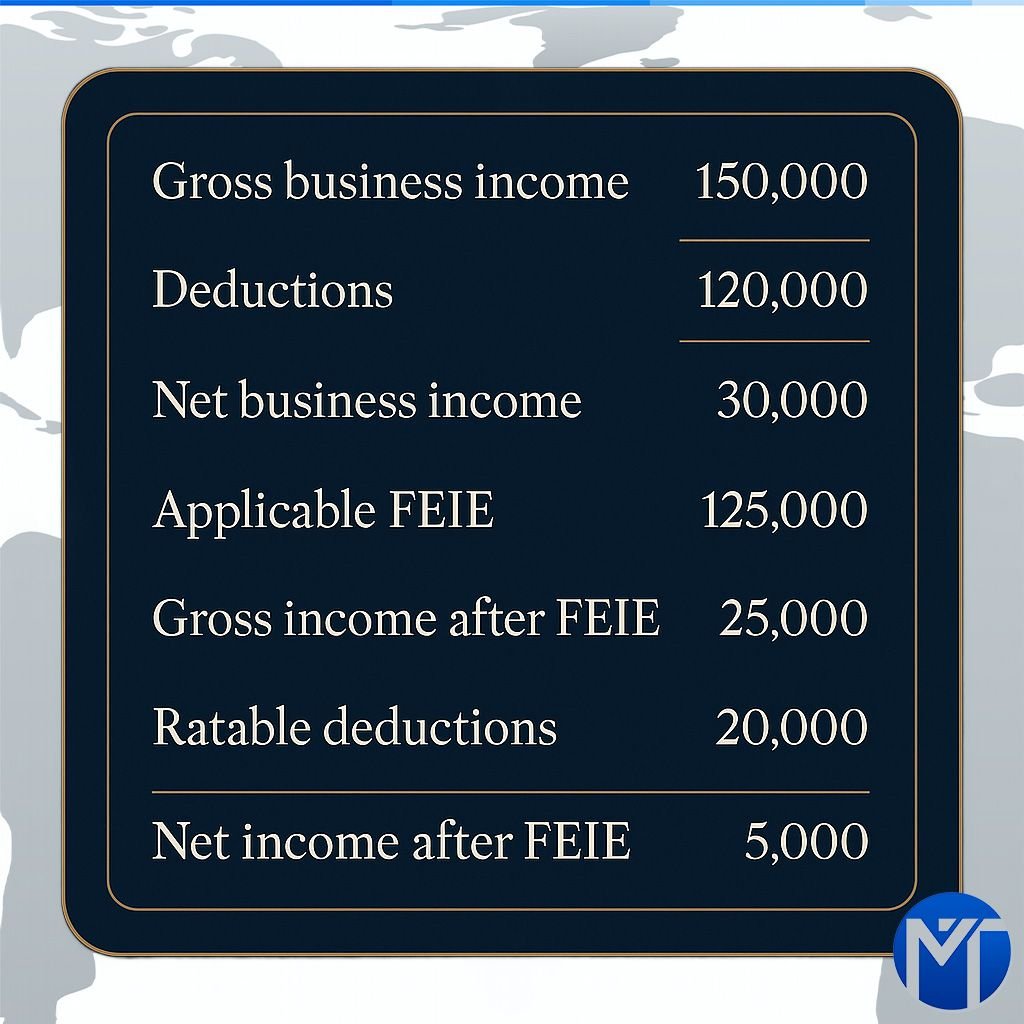

The rules under Section 911 are clear in that they can apply to self-employed/business income in the same manner as a salary. The exclusion is against gross income, so in a self-employed scenario the exclusion would go against the gross receipts and then the expenses would be reduced proportionately. This can sometimes give you an unexpected result.

FEIE Can get pretty complicated outside of standard situations

As you can see from the example, you might expect the 125k allowable foreign earned income exclusion to fully offset the net business income of 30k. However, since it is applied on the gross income it still leaves some leftover taxable income of $5,000.

When you bring on a partner into the business, the same rules and concepts apply. Of course this calculation can get a little more complicated as the “source” of the income may not be quite as clear.

I have a simple two step process for applying the FEIE to business/partnership income.

Step 1: Do we have a capital intensive business?

The first step is to determine if the business income is solely a result of services being provided or if capital is a

producing factor. More clearly, are there significant assets in the business that drive revenue or is it mainly from the provision of services.In the case where capital is a material income producing factor in the business as well as services, a reasonable allowance for compensation for services rendered by the taxpayer is considered earned income. This amount considered “earned income” (i.e., eligible for the FEIE)

of the individual profit share in the business for the year.There is not an objective test to make this determination. You really have to look at all the facts and circumstances. One of the seminal cases in this area reached its conclusion that capital was a material income producing factor on the grounds that total charges for material exceeded total charges for labor. Also, that the value of inventory was significant in relation to net operating profit.

A good rule of thumb is to look out for businesses that require substantial inventories or investment in plant, machinery, or equipment. In this case the 30% limitation will likely apply.

Step 2: Is there foreign earned income?

The next step is to determine the source of the income. Assuming we have a strictly service based business, the source of the income will depend on where the services are physically performed. This of course can be tricky if you have multiple people performing services both in and outside the US.

In our current situation, we would need to derive some sort of value on the services being provided outside the US that partner. That valuation in relation to the full business valuation could be a reasonable proxy for the annual gross income allocated to foreign sources.

This sourcing would need to be documented in the Sch. K2/K3 to the partner as documentation of the sourcing. So really this analysis needs to be performed at the partnership level and not the partner level.

As you can see, this is complicated and something that would require a valuation or transfer pricing specialist to assist with. This is why I generally recommend the guaranteed payment option.

A “

” is a payment that is made by a partnership to a partner for services or the use of capital and that is determined without regard to the income of the partnership. The that guaranteed payments are treated as compensation for purposes of the FEIE. So in this case, we just have to make sure the individual meets the other requirements with respect to the FEIE and that they are performing the services related to the payment in a foreign country.In conclusion, a partner can be eligible for the FEIE if they are performing services for the partnership outside the US. It is much simpler to set up guaranteed payments, although it is also possible to allocate eligible foreign source income to a partner through their share of partnership income.